Recent events have highlighted significant concerns regarding CEX.IO, a UK-based cryptocurrency exchange, and its business practices.

This article aims to warn potential users of the possible risks associated with using CEX.IO, emphasizing its regulatory non-compliance, questionable business practices, and potential conflicts of interest.

One of the most pressing concerns is CEX.IO’s status in the UK.

Despite being a significant player in the cryptocurrency market, we exposed in our last article how CEX.IO mysteriously withdrew its application to register as a crypto asset business with the UK Financial Conduct Authority (FCA) in late 2022.

This move came after the platform began publicly raising crypto for unknown entities within the Ukrainian regime, violating the FCA’s stringent regulations intended to ensure the safety and security of cryptocurrency transactions and user funds.

By withdrawing its application, CEX.IO is now operating in the UK without adhering to the regulatory standards set forth by the FCA.

This regulatory gap means that the platform is not subject to the same scrutiny and oversight as other exchanges that comply with FCA regulations. Consequently, users of CEX.IO may be at a higher risk of losing their funds due to potential mismanagement or fraudulent activities.

UPDATE September 2024

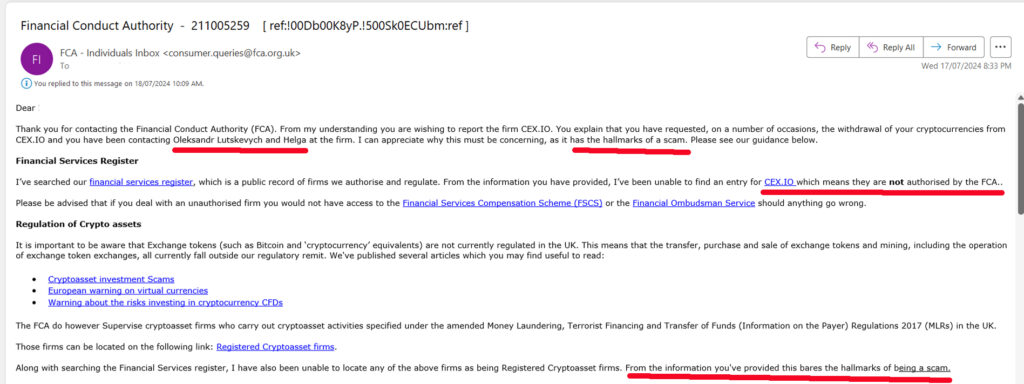

Its been confirmed by the FCA UK that CEX.IO has never been registered with the FCA.

This action taken by the Ukrainian management has been used to exploit people and expose them to fraud.

Withholding of User Funds

There have been troubling reports of CEX.IO withholding users’ cryptocurrency without providing clear explanations or timely responses.

Users have claimed that despite fulfilling all necessary compliance and verification requirements, they have been unable to withdraw their funds.

In some cases, users were allowed to withdraw their funds one day, only to be denied access the next, without any justification or communication from the exchange.

Such practices raise serious concerns about the platform’s integrity and its commitment to safeguarding users’ assets. The inability to access one’s funds can lead to significant financial and emotional distress, undermining the very trust that users place in these platforms.

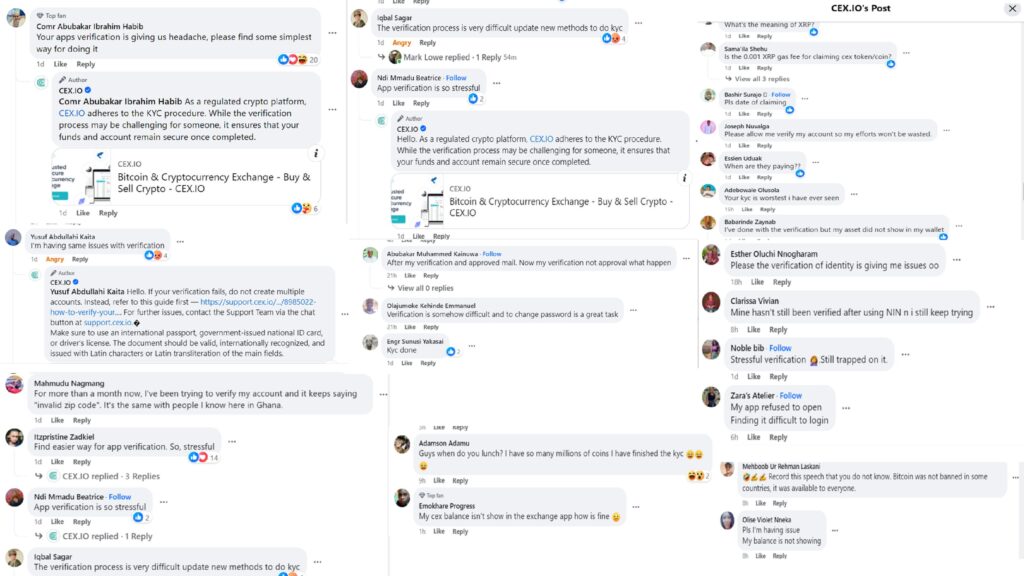

An in-depth investigation of CEX.IO’s social media accounts revealed that the company, owned by a Ukrainian, predominantly targets Africans and people from the Middle East.

Out of 1,000 accounts examined, over 80% were from these regions. This raises questions about the company’s marketing practices and its intentions.

Interviews with 50 individuals from these regions, who were having trouble getting their accounts verified, revealed a pattern of deceit.

The majority were enticed by CEX.IO’s marketing to deposit $100 into an account, believing they would receive extra tokens as a reward. They were then told they could trade on the platform and make money as Bitcoin’s value rose. However, when they tried to withdraw their money, they faced an impossible verification process. Documents submitted 10 to 15 times were repeatedly rejected, leaving users unable to access their funds.

About 20% were told they had crypto in these accounts and would be rewarded if they created an account. This appears to be a tactic to drive traffic to the site and boost its ranking through Google Analytics.

CEX.IO’s founder and CEO, Oleksandr Lutskevych, resides in the UK but is a Ukrainian national and has publicly shown support for Ukraine amid the ongoing conflict with Russia, the platform’s promotion of sending cryptocurrency to Ukraine raises questions about potential conflicts of interest, especially considering the significant sums of money involved in cryptocurrency transactions.

This also raises concerns about whether the withheld crypto from legitimate traders is being siphoned off to Ukrainian entities.

Lack of Regulatory Response

Despite these significant red flags, the FCA has stated that exchange tokens such as Bitcoin and ‘cryptocurrency’ equivalents are not currently regulated in the UK. This means that the transfer, purchase, and sale of exchange tokens, including the operation of exchange token exchanges, fall outside the FCA’s regulatory remit.

Consequently, users dealing with an unauthorised firm like CEX.IO do not have access to the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service should anything go wrong.

In response to a complaint, the FCA advised consulting with home state regulators such as FinCEN in the USA, the Bank of Lithuania, and authorities in Nevis, where CEX.IO has registered entities. However, attempts to contact these regulators have often been met with silence.

Conclusion

The combination of regulatory non-compliance, reported withholding of user funds, and potential conflicts of interest presents significant risks to users of CEX.IO. The platform’s targeting of vulnerable markets and the inability to withdraw funds raise serious ethical and legal questions.

Potential and current users of CEX.IO are urged to exercise caution. Choosing a cryptocurrency exchange is a critical decision that can significantly impact your financial well-being.

It is advisable to opt for platforms that are fully compliant with regulatory requirements, have a proven track record of safeguarding user funds, and operate with the highest levels of transparency and integrity.

Your financial security should always be the top priority when navigating the complex and often volatile world of cryptocurrency.

In light of these issues, users should consider alternative platforms that adhere to regulatory standards and provide greater transparency and accountability.

If you have been affected by CEX.IO’s practices, it is crucial to report your experiences to the relevant regulatory authorities and seek legal advice to recover your funds.