Understanding the Risks of Unregulated Cryptocurrency Exchanges

In the rapidly growing world of cryptocurrency, investors are often lured by the promise of high returns and the allure of cutting-edge technology. However, as the market expands, so do the risks associated with investing in digital assets. One such risk is the misconception surrounding the regulatory status of cryptocurrency exchanges.

A prominent example of this is CEX.IO, a cryptocurrency exchange that claims to be compliant with various regulatory bodies. This article aims to shed light on the reality of CEX.IO’s regulatory status and the implications for investors, including real-life accounts of investors who have experienced significant losses.

The Illusion of Safety: CEX.IO’s Regulatory Claims

CEX.IO promotes itself as a safe and legitimate platform for trading cryptocurrencies, often citing its registrations with regulatory bodies in the UK, USA, Gibraltar, and Lithuania. However, a closer examination reveals that these claims do not offer the level of protection that investors might expect.

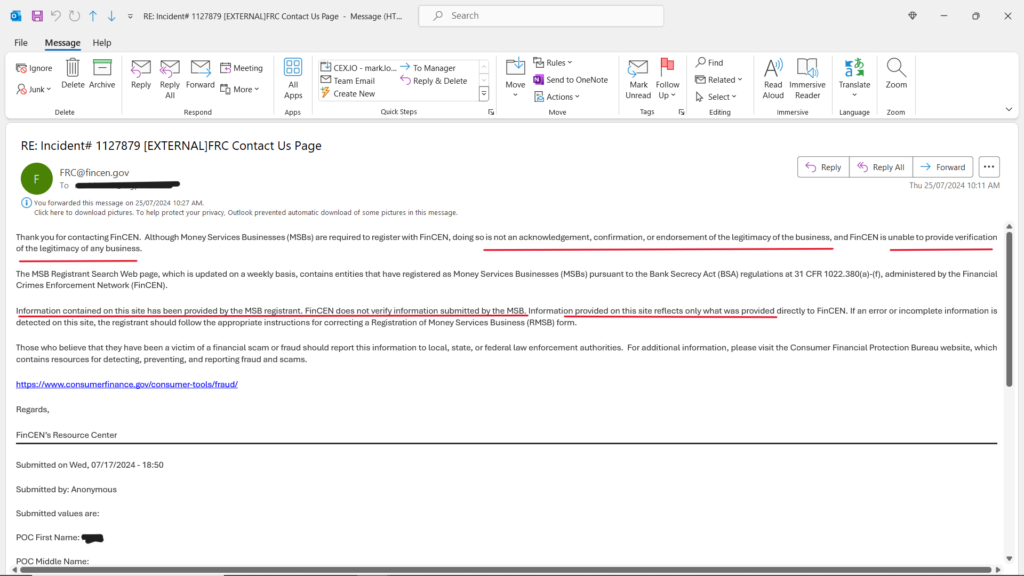

- Financial Crimes Enforcement Network (FinCEN) in the USA:

- Claim: CEX.IO is registered as a Money Services Business (MSB) with FinCEN, suggesting a high level of regulatory scrutiny.

- Reality: FinCEN has clarified that registration as an MSB is not an endorsement or verification of a company’s legitimacy. FinCEN does not verify the information submitted by MSBs, meaning that registration alone does not guarantee that the business operates legitimately or safely. (See Below Response from FinCEN)

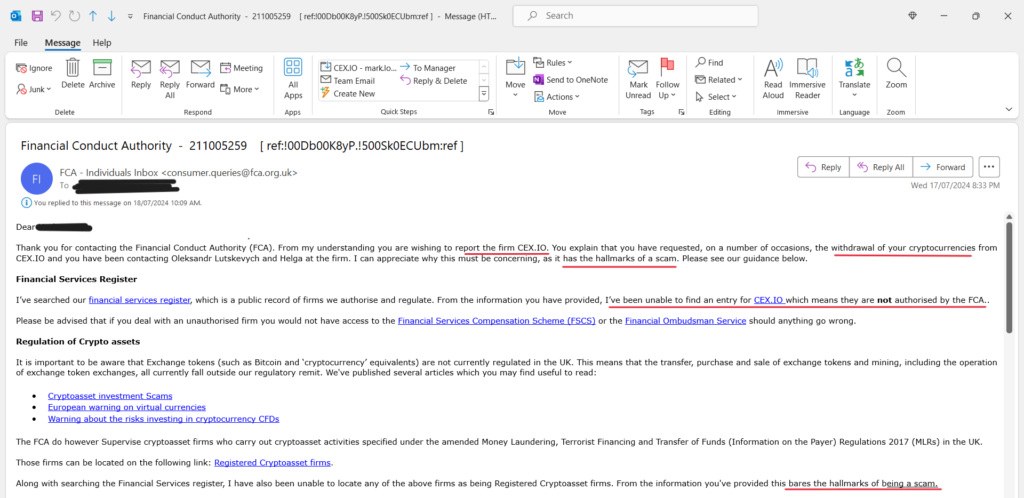

- Financial Conduct Authority (FCA) in the UK:

- Claim: CEX.IO implies that it is working with the FCA’s regulations to overcome some “issues” with its UK operations.

- Reality: The FCA has confirmed that CEX.IO is not authorized or regulated by them to offer financial services or products. The FCA’s role is to regulate specific activities, and CEX.IO does not fall under these regulated activities, thus leaving investors without the protection they might assume. Furthermore, on May 31, 2022, CEX.IO formally withdrew its application for registration with the FCA under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLRs). As a result, CEX.IO Ltd was removed from the FCA’s Temporary Registration Regime (TRR) with effect from June 30, 2022. This withdrawal means CEX.IO operates as a self-regulator, allowing them to handle your assets with little external oversight. (See Below Response from FCA and their reference to being a scam)

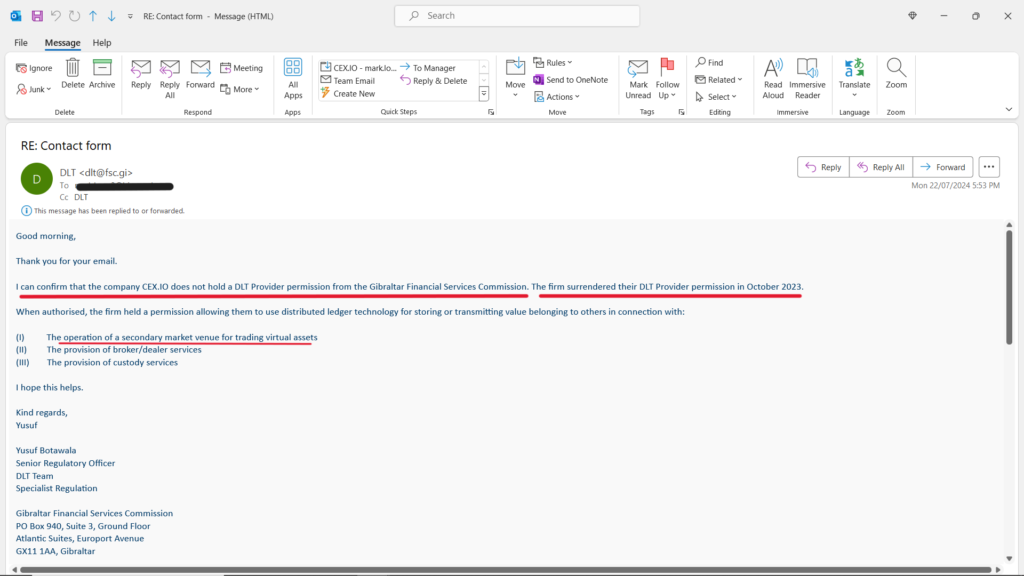

- Gibraltar Financial Services Commission (GFSC):

- Claim: CEX.IO previously held a Distributed Ledger Technology (DLT) Provider permission from the GFSC.

- Reality: CEX.IO surrendered its DLT Provider permission in October 2023 and no longer holds any authorization from the GFSC. Any current claims of regulation from Gibraltar are therefore misleading. (See Below Response from GFSC)

- Virtual Asset Service Provider (VASP) Registration in Lithuania:

- Claim: CEX.IO’s registration as a VASP in Lithuania is often highlighted as a mark of regulatory compliance.

- Reality: The Lithuanian VASP registration primarily functions as a registry and does not involve active regulation or accountability. This registration should not be interpreted as comprehensive regulatory oversight. (No Response to our requests regarding the regulatory body and status of CEX.IO)

The Realities of Unregulated Exchanges

The disparity between CEX.IO’s regulatory claims and the actual oversight provided by these bodies exposes investors to significant risks. Without the stringent protections and enforcement mechanisms that come with true regulatory oversight, investors are vulnerable to potential fraud, mismanagement, and financial loss.

Adding to the concerns is the background of CEX.IO’s founders. The company was started by Ukrainians, and Ukraine is widely regarded as the most corrupt country in Europe. There have been reports of CEX.IO transferring money to Ukraine, claiming that these funds are being donated to charities. However, investigations have found no records of such donations, raising further questions about the transparency and integrity of the exchange.

Real-Life Stories of Missing Cryptocurrency

Many investors have faced severe consequences due to the lack of genuine regulatory oversight at CEX.IO. Here are a few examples:

- Case Study 1:

- Peter (Alis), a seasoned investor, had been trading on CEX.IO for approximately 10 years. In June 2024, he discovered that his account balance had plummeted from 2.485 BTC to 0.066 BTC without any explanation. Despite multiple requests for withdrawals and attempts to resolve the issue, he received only generic responses and automated messages. His efforts to escalate the matter to regulatory authorities revealed the true extent of CEX.IO’s unregulated status, leaving him with significant financial losses.

- Case Study 2:

- Jane (Alis) invested her savings into cryptocurrencies through CEX.IO, enticed by their promotional offers and the promise of high returns. However, when she attempted to withdraw her funds, she encountered numerous delays and unresponsive customer service. After months of frustration, she learned that her investments were not protected by any regulatory body, leaving her without recourse to recover her lost funds.

- Case Study 3:

- John (Alis), who had only been investing for a short time, trusted CEX.IO based on their claims of regulatory compliance. He deposited a substantial amount of money into his account, only to find that his funds were inaccessible when he needed them most. His inquiries were met with vague responses, and he eventually realized that the exchange’s registration with bodies like FinCEN and the FCA did not equate to meaningful oversight or protection.

These are just some of the people who have come forward. Many don’t wish to speak out as they feel ashamed to do so.

Protecting Yourself as an Investor

To safeguard your investments in the cryptocurrency market, consider the following steps:

- Verify Regulatory Status:

- Conduct thorough research to understand the true regulatory status of any exchange. Do not rely solely on the exchange’s claims; instead, verify with the regulatory bodies themselves.

- Understand the Limits of Registration:

- Recognize that being registered with a regulatory body does not necessarily mean that the exchange is actively regulated. Understand the difference between mere registration and comprehensive regulation.

- Use Reputable Exchanges:

- Prefer exchanges that are well-established and have a proven track record of compliance with robust regulatory frameworks.

- Stay Informed:

- Keep up-to-date with news and alerts from financial regulators and consumer protection agencies to be aware of any warnings or issues related to specific exchanges.

Conclusion

While the promise of cryptocurrency investments can be enticing, it is crucial to remain vigilant and well-informed. CEX.IO’s claims of regulatory compliance can create a false sense of security, leaving investors exposed to significant risks. By understanding the realities of regulatory oversight and taking proactive steps to protect your investments, you can navigate the cryptocurrency market more safely and confidently.

This article aims to educate and warn investors about the risks associated with CEX.IO and the importance of verifying the regulatory status of cryptocurrency exchanges. By highlighting the disparity between CEX.IO’s claims and the actual regulatory protections in place, along with real-life stories of investors’ losses, the article seeks to promote informed investment decisions.

We have reached out to CEX.IO for comment but they have not responded to our requests.