CEX.IO, a well-known cryptocurrency exchange, has recently come under scrutiny due to conformation of Bitcoin theft involving one of its customers, who claims that 2.434 BTC disappeared from his account under suspicious circumstances. These claims, coupled with an insider’s revelations about corrupt practices and collusion with external political regimes, expose a darker side of the exchange that contradicts its public image of transparency and security.

The Disappearance of 2.434 BTC: A Timeline of Events

Mr Lowe, a long-time CEX.IO user, reported that his Bitcoin balance mysteriously dropped from 2.5 BTC to 0.066 BTC between June 12 and June 15, 2024. Despite his repeated attempts to resolve the issue, CEX.IO’s customer service has denied the possibility of any such theft. Instead, the exchange maintains that as of March 4, 2024, his account balance was 0.092 BTC. According to the company, a withdrawal of 0.026 BTC was made on June 10, 2024, leaving him with 0.066 BTC, and no additional funds were debited.

On September 24, 2024, 4 months after he brought the thief to the attention of CEX.IO they finally responded to his complaints by sharing CSV files containing his account transaction history from December 5, 2017, to August 5, 2024. They claimed that after a thorough review of his account history, they could find no evidence that him ever had 2.5 BTC in his account during the “period in question.” The email goes on to ask for further evidence, including a screenshot or transaction hash from Coinbase, where he claims to have made his deposit.

CEX.IO’s refusal to acknowledge the missing funds and their insistence on shifting the blame back onto Mr Lowe is concerning. The fact that they provided an editable Excel spreadsheet as proof is problematic, as CSV files are easily manipulated. This raises questions about whether the transaction history was tampered with to conceal the theft. The burden of proof has been placed on him to verify his claims, which further demonstrates CEX.IO’s reluctance to fully investigate the matter.

Insider Revelations: Cold Storage Manipulation and Fake Accounts

In a shocking twist, an insider at CEX.IO has come forward with damning allegations that shed light on how the exchange has be engaging in fraudulent practices. According to this whistleblower, CEX.IO’s cold storage system—supposedly designed to secure user funds—has been manipulated by corrupt actors within the company. These individuals have the ability to alter account balances by simply changing the digits in users’ accounts, diverting the missing funds into fake accounts under the control of CEX.IO’s directors and managers.

This revelation is particularly troubling in the case of Mr Lowe’s missing 2.434 BTC. The insider stated in an email that his funds may have been siphoned off into one of these dummy accounts, with no trace left behind due to the manipulated transaction records. The fact that his account balance was reduced so drastically and that CEX.IO’s official records don’t reflect his initial 2.5 BTC balance lends credibility to the insider’s assertion that the company is engaging in deceptive practices.

This insider also revealed that CEX.IO’s upper management is in regular communication with corrupt officials in the Ukrainian government, specifically within the regime of President Volodymyr Zelensky. These individuals are allegedly involved in bribery and money laundering schemes that use CEX.IO’s platform to move funds illicitly, often freezing the accounts of customers from Russia and Belarus without any legal basis.

The September 24, 2024 Email: Picking Apart the Response

CEX.IO’s response to Mr Lowe on September 24, 2024, raises several red flags. In their email, they claim to have conducted a “detailed analysis” of his account activity and conclude that his balance never reached 2.5 BTC. However, the lack of a straightforward explanation as to why his account was reduced to 0.066 BTC in June 2024 without his authorization is suspicious. Furthermore, their reliance on CSV files as definitive proof of his transaction history is highly questionable.

CSV files can be easily created, edited, and manipulated in programs like Excel, which means they cannot be considered infallible evidence in cases of alleged theft. CEX.IO’s decision to provide him with such a document, rather than more concrete evidence such as blockchain transaction hashes or audit trails, casts doubt on their commitment to transparency.

His follow-up email on September 30, 2024, expresses frustration at the lack of response and accuses CEX.IO of transferring his missing BTC to a dummy account controlled by company insiders. His claim that CEX.IO’s management is involved in bribery with the Ukrainian regime further highlights the deep-rooted corruption within the company. The fact that his accusations have gone unanswered speaks volumes about CEX.IO’s willingness to engage with legitimate concerns from its users.

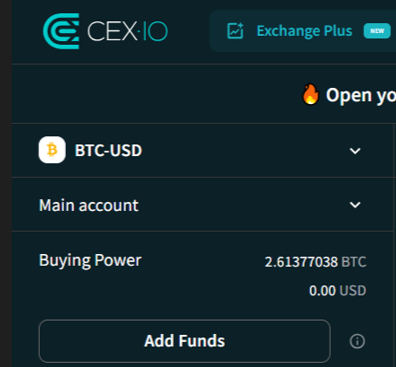

With a screen shoot clearly indicating over 2.5 BTC in his CEX.IO account, Yet CEX.IO ignores all requests for the safe return of his BTC.

The Allegations of Bribery and Political Collusion

The insider’s allegations of CEX.IO’s involvement with the Ukrainian regime are alarming. According to the whistleblower, bribes are regularly funnelled to key officials within the Zelensky government, allowing the exchange to operate with impunity. These bribes, reportedly paid in both cryptocurrency and USD, serve to protect CEX.IO from legal scrutiny and enable the continued freezing of accounts belonging to customers in politically targeted regions like Russia and Belarus.

These account freezes, which CEX.IO justifies as compliance with sanctions, are carried out without any legal basis. Customers from these countries often find themselves unable to access their funds, with little to no explanation provided by the exchange. This behaviour is not only unethical but also illegal, as it violates the basic rights of customers to access their legally obtained funds.

The implications of this insider testimony are far-reaching. If CEX.IO is indeed engaging in these illicit activities, it represents a significant breach of trust for its users and a potential violation of international law. The involvement of a politically unstable regime in such practices further complicates the situation, as it raises concerns about the exchange’s ability to operate fairly and transparently on a global scale.

The Silent Admission: What CEX.IO’s Lack of Response Means

Mr Lowe’s frustration is palpable in his follow-up email on September 30, 2024. He points out that CEX.IO’s silence on the matter suggests a tacit admission that his 2.434 BTC was indeed in his account at one point and was later stolen. His accusations that the stolen BTC was placed in a dummy account controlled by CEX.IO’s directors are serious, yet the company has yet to issue a public response or take concrete steps to investigate the matter further.

CEX.IO’s refusal to engage with his claims of theft raises questions about their commitment to customer protection. If the exchange were truly committed to transparency and security, they would have launched an internal investigation and provided him with the information he requested, such as the blockchain transaction hash for his missing BTC. Instead, they have chosen to deflect blame onto the customer, leaving the matter unresolved and casting doubt on their integrity.

Conclusion: A Call for Accountability and Transparency

The allegations against CEX.IO paint a troubling picture of an exchange that may be actively engaging in fraudulent practices and colluding with corrupt political regimes. Mr Lowe’s case is just one example of how CEX.IO’s management is manipulating account balances, freezing accounts without legal authority, and siphoning off user funds into fake accounts.

The insider’s revelations about cold storage manipulation and political corruption add another layer of complexity to the situation. These claims indicate that CEX.IO is not only deceiving its users but also engaging in illegal activities that could have far-reaching consequences for the broader cryptocurrency community.

For CEX.IO to regain the trust of its users, it must take immediate steps to address these allegations. This includes launching a full internal investigation into Mr Lowe’s missing BTC, providing verifiable blockchain evidence of all transactions, and ending the practice of freezing accounts without legal justification. Furthermore, the company must distance itself from corrupt political regimes and commit to operating transparently and ethically.

Without these actions, CEX.IO risks losing its reputation as a trusted cryptocurrency exchange and may face legal repercussions for its alleged involvement in criminal activities. As the world of cryptocurrency continues to evolve, it is crucial that exchanges like CEX.IO are held accountable for their actions and operate with the integrity and transparency that their users expect and deserve.