The Institute of International Finance (IIF) has issued a warning that global debt has reached unprecedented levels, exceeding its pre-pandemic figures by a staggering $45 trillion.

In the first quarter of this year alone, the global debt pile rose by $8.3 trillion, reaching a near-record high of $305 trillion. The surge in debt can be attributed to the aggressive monetary policy tightening pursued by central banks worldwide, as revealed in the IIF’s Global Debt Monitor report.

The report disclosed that this current debt reading is the highest since the first quarter of last year and the second-highest ever recorded in a single quarter.

The IIF also expressed concerns about the ramifications of such elevated debt levels and the simultaneous increase in interest rates. The cost of servicing this debt has soared, leading to apprehensions about the potential risks associated with leverage within the global financial system.

The IIF further warned that the combination of high debt and rising interest rates could result in a credit crunch. This would lead to an upsurge in default rates and the emergence of more “zombie firms,” which currently account for an estimated 14% of US-listed companies.

Despite recent turmoil in the banking sectors of the United States and Switzerland, the IIF emphasized the need for continued government borrowing.

The finance industry body stressed that governments face ongoing pressure to maintain elevated levels of borrowing due to challenges such as ageing populations, rising healthcare costs, and heightened geopolitical tensions.

The increasing tension in international relations is also expected to drive further rises in national defence spending in the medium term. These factors can potentially impact the credit profiles of both governments and corporate borrowers, which could have significant implications for international debt markets, particularly if interest rates remain high for an extended period.

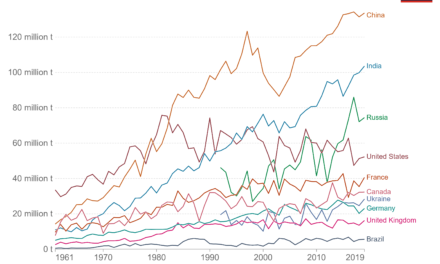

The report also highlighted that total debt in emerging markets had reached an all-time high of over $100 trillion, equivalent to approximately 250% of GDP. This figure represents a substantial increase from the $75 trillion recorded in 2019. China, Mexico, Brazil, India, and Türkiye were identified as the major contributors to this upward trend in emerging markets’ debt.

Among developed economies, Japan, the United States, France, and the United Kingdom witnessed the sharpest increases in debt during the quarter, according to the IIF’s report.

In summary, global debt has surged to unprecedented levels, surpassing the figures recorded prior to the pandemic by a substantial margin. The combination of high debt levels and rising interest rates have raised concerns about the cost of servicing debt and the potential risks to the financial system. Governments are under pressure to maintain elevated borrowing levels due to various challenges, while emerging markets are grappling with significant increases in debt. The IIF has emphasized the need for caution, highlighting the potential implications for international debt markets if interest rates remain high for an extended period.