As the Reserve Bank of Australia (RBA) prepares to meet on Melbourne Cup day, most analysts and all the media are predicting and pushing for only a 0.25% rise.

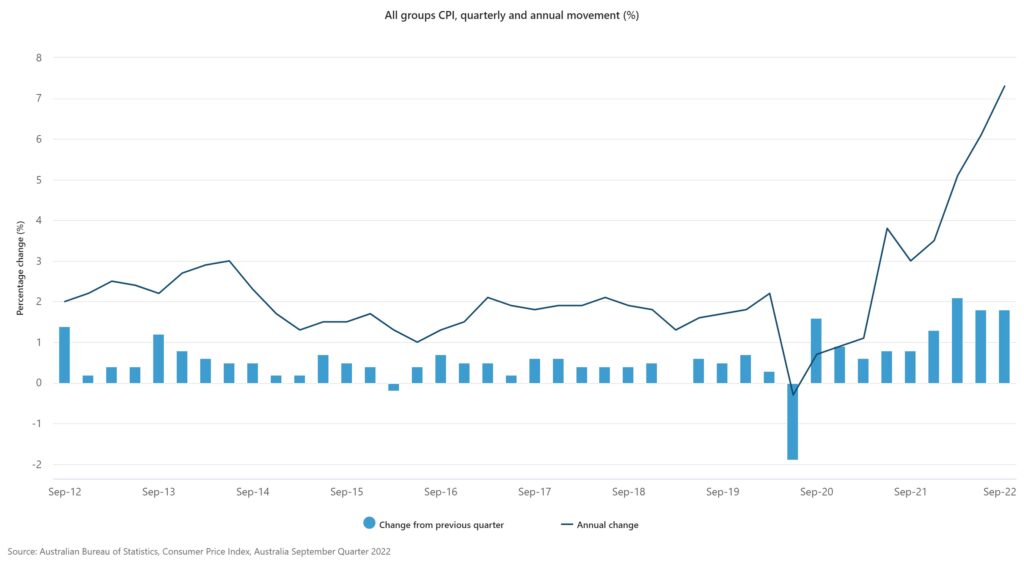

The release of the September Consumer Price Index (CPI) figures last week, showed a rapid rise in inflation to 7.1% and with CPI over 8.4%.

As predicted here back in June that the next lot of figures would be over 7.0%, we were correct with our assessment of the Australian economy.

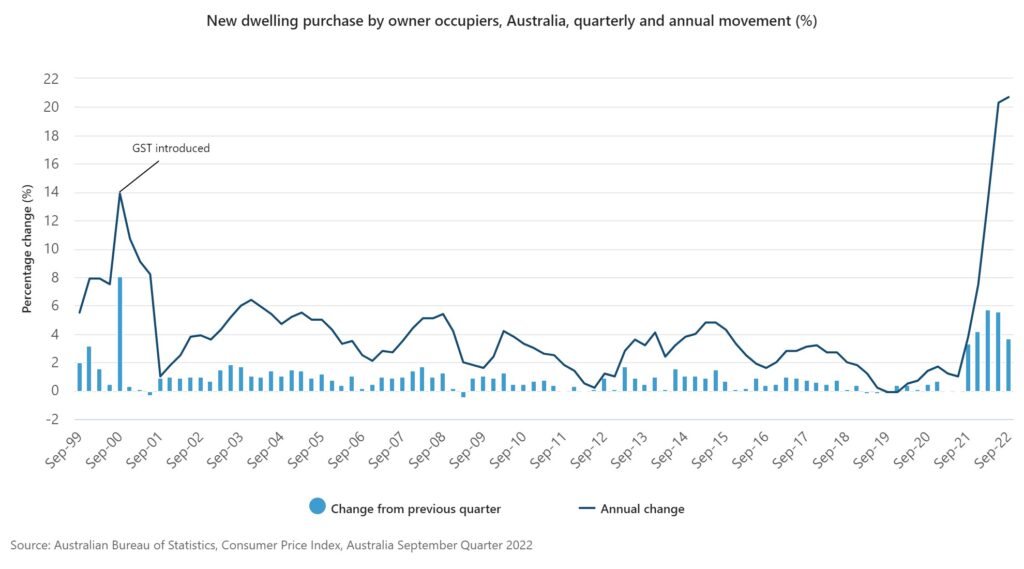

The most significant price rises were New dwelling purchases by owner-occupiers up (+3.7%), Gas and other household fuels up a whooping (+10.9%) and Furniture up (+6.6%).

The annual CPI movement of 7.3 per cent is the highest since 1990.

The past four quarters have seen strong quarterly rises off the back of higher prices for new dwelling construction, automotive fuel, and food.

Trimmed mean annual inflation, (A way to lower the real rate) which excludes large price rises, increased to 6.1 per cent.

This is the highest since the ABS first published the figures in 2003.

The high levels of construction activity and ongoing shortages of labour and materials continue to drive higher prices for new dwellings. Although the rate of price growth eased somewhat this quarter compared to the highs seen in recent quarters, in annual terms, the series recorded the largest rise since it commenced in 1999.

The ABS also blames the governments’ reduction in payments for part of the rise stating that “Fewer payments of government construction grants compared to the previous quarter also contributed to the rise this quarter. These grants have the effect of reducing out-of-pocket expenses for new dwelling purchases.”

There are strong price rises across all food and non-food grocery products in the September quarter. The RBA contributes these rises to “a range of price pressures including supply chain disruptions, weather-related events, such as flooding, and increased transport and input costs.” Not government policies that saw the small business section destroyed.

They also point to a rise in the September quarter prices in the fruit and vegetable sector of 16.2% and dairy sector of 12.1%. But they do not give any reasons for these rises, even though the sanctions on The Russian Federation have seen fuel prices rise and restricted urgently needed fertilisers from being made available to farmers.

The figures from the Australian Bureau of Statistics point to further collapses within the economy. And with a budget that delivers nothing new to stimulate an economy out of control.

The RBA trying to please corporations and politicians with a 0.25% being the likely outcome, but that will be too little too late for the future of small businesses and families that have overstretched their lending capacity.