As Reserve banks scramble to raise interest rates in Western countries due to inflation, the Bank of Russia cuts their interest rate by 150 points (1.5%).

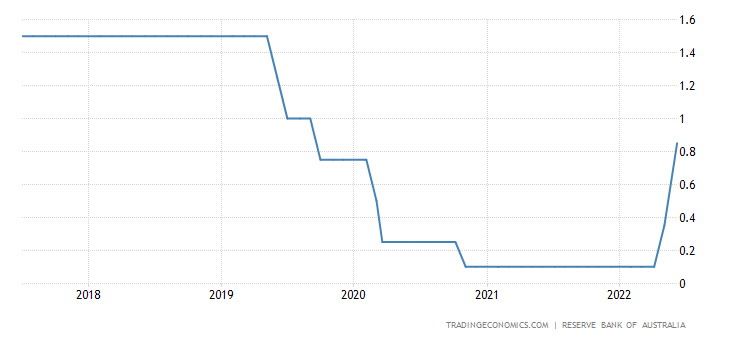

On June the 8th the Australian Reserve Bank increased its interest rates by 0.5%, this was after it lifted its interest rates in May by 0.25% leaving the reserve bank interest rate at 0.85%.

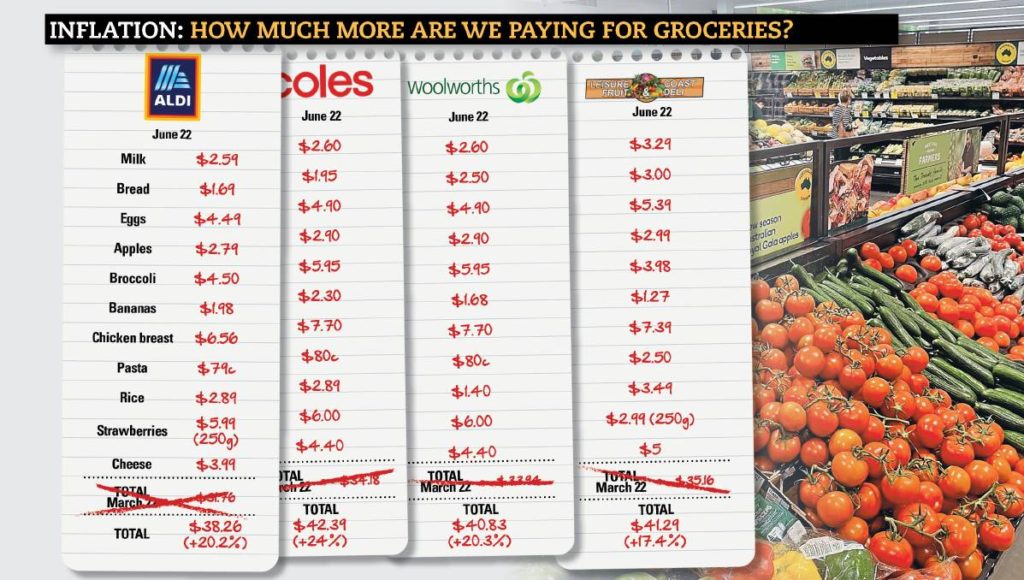

These rate risers saw consumers in Australia and some analysts condemning the move while voicing their outrage on social media outlets, as Australians come to grips with their addiction to cheap money. This latest rate rise comes amidst a survey that was conducted comparing food prices on average everyday items from March to June.

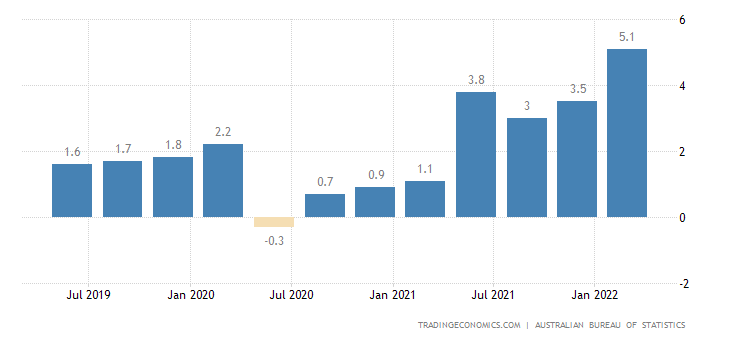

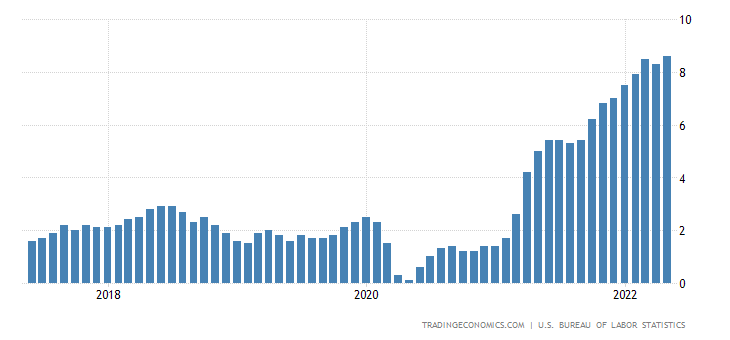

The survey shows an average increase of approximately 20% increase in staple foods in just the last 3 months. While the RBA reported inflation at 5.1% in March, analysts are tipping inflation to be still rising when the next 3 months worth of figures are released. With the price of food increasing and fuel which is now over $2.00 AUD per litre, I am tipping that the next set of figures should be over 6.0%., with September’s figures reaching +7.0%

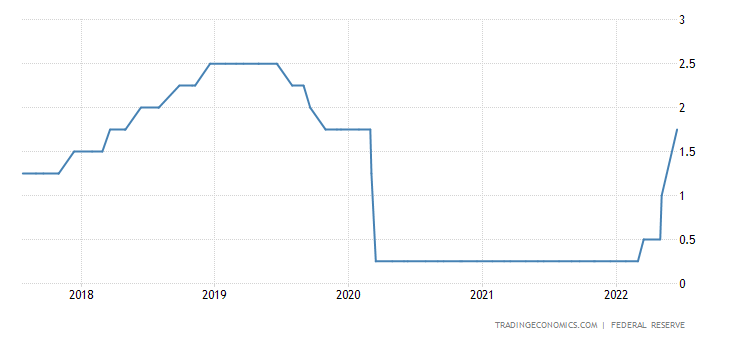

Meanwhile, in the US the Federal Reserve has increased its federal funds rate by 0.75% in its biggest single hike since 1994. The Federal Reserve rate now sits at 1.5-1.75%.

This comes as the economic numbers were worse than expected with May’s official inflation in the US rising to 8.6% even though we were assured that inflation had peaked in March at 8.5% and after April recorded a drop to 8.3%. Some analysts predict the real inflation number is well over 10%.

Fuel prices have fueled the last increase in inflation that is rapidly forcing all other sectors to rise due to the reliance on energy to grow, harvest, refine, produce and transport goods to consumers. Also, the end of COVID handouts in the form of stimulus packages of free money has increased the US overall debt to over $30 Trillion. These “stimulus packages” have done little to help the average to low-income worker, and were designed to enable the elites to gain an ever-increasing hold on wealth

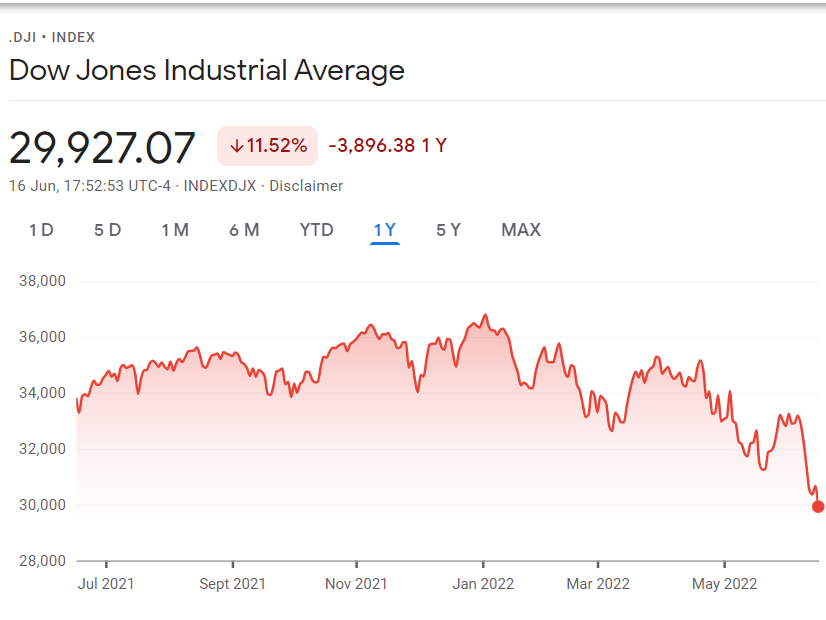

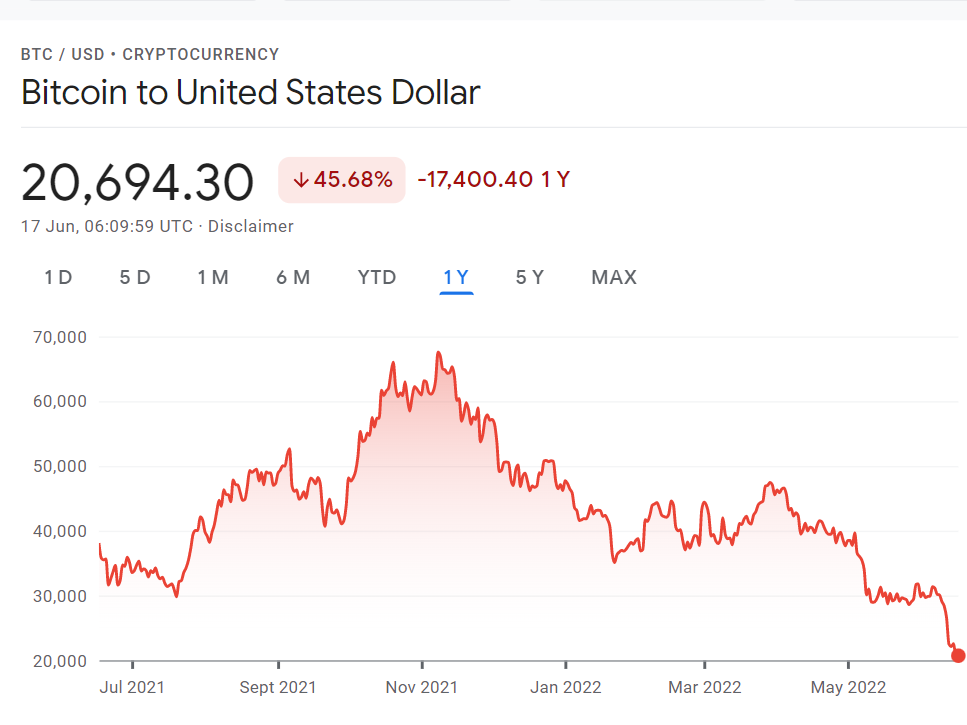

At the same time, the world stock markets continue to take a hit even after the Fed rate rises the Dow Jones finished below 30,000 points from a high of 36,500 points in early November 2021. This panic sell-off has also seen Bitcoin fall to $20,000 USD from a high of $67,000 USD also in November 2021.

This is a stark contrast to the Russian economy that since 2014 has had sanctions placed on its industries, financial institutions and individuals.

Since that time the Russian government implemented policies that have seen it become self-reliant on most everyday items, for example before 2014 Russia imported a large amount of cheese mainly from the EU, and after the EU joined the sanctions war, Russia reciprocated by restricting the importation of foreign cheese from unfriendly countries. This action fostered a booming industry with Russian manufacturers building a world-class cheese industry, today you can buy any cheese type made in Russia. Agriculture has also seen a huge change, fruit that was once grown in the EU and shipped to Russia has all but disappeared with Russia now growing most of its fruit or importing from “friendly countries”

With the special operations and the now over 11,000 sanctions on Russia. Western countries seized the opportunity to collapse the Russian economy and seize control of its government. The sanctions were designed to push the country into hyperinflation and fester discontent within its people to depose the government allowing the Western vultures to swoop in and take control with the corporations stripping Russia like a rotting carcase decomposing in the hot desert sun.

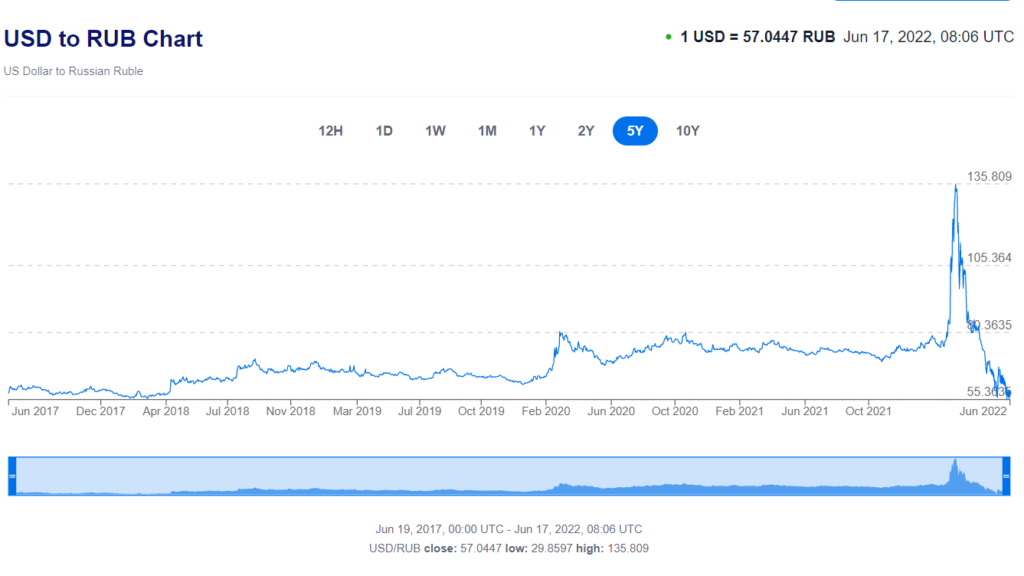

In contrast, we see that the quick and decisive moves by the Bank of Russia not only stabilised the currency but made it the strongest currency in the world (Bloomberg). This was a group effort but was led by one person Elvira Nabiullina the Governor of the Bank of Russia. As sanctions started hitting the Russian economy and the ruble fell from 75 RUB to 1 USD to 150 RUB to 1 USD.

Even though it is interesting that the latest data (above) shows that the USD to RUB only fell, to 135.809 RUB to 1 USD. NOT 150.119 RUB as the chart from March clearly shows (below.) It seems that the western markets are trying to manipulate the dramatic turnaround that the Russian economy has achieved despite the harshest sanctions ever seen.

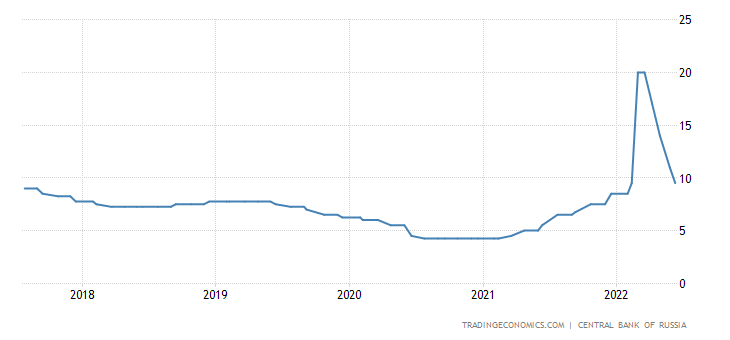

The Bank of Russia immediately raised interest rates from 9.75% to 20%. This had dramatic effects with investors and ordinary people leaving money in banks while the banks passed on all the reserve rates of interest to consumers. That meant that if you had 10,000 USD in the bank ( 1,500,000 RUB) you would earn 166 USD per month (25,000 RUB). This incentive to save instead of spending coupled with western countries now refusing to ship goods to Russia meant that Russians could only buy goods that were made or produced in Russia or a friendly country. Russian banks were flooded with money being invested short-term. The immediate impact was to see the Ruble strengthen and push back against the US and other foreign currencies.

As the chart shows the Bank of Russia has now eased interest rates after containing inflation and securing the currency from collapse and hyperinflation.

The plan from the Imperial west to destroy the Russian economy and force a coup d tar has failed. Now they turn their attention to collapsing western economies to increase their balance sheets as we see that shares and soon house prices start to tumble.

When will western people wake up that their economies are designed to serve only the elite and to continue to enslave the rest of the populous with ever-increasing debt?